Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

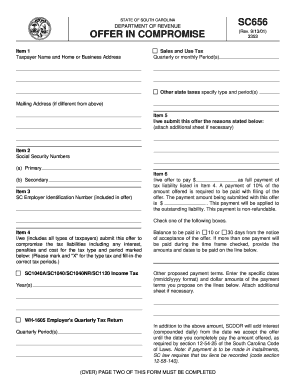

What is form sc656 offer in?

Form SC656 is an offer in compromise (OIC) proposal that taxpayers can use to negotiate a settlement with Her Majesty's Revenue and Customs (HMRC) in the United Kingdom. The OIC allows taxpayers who are unable to pay their tax debt in full to propose a lower amount that they can afford to pay.

Who is required to file form sc656 offer in?

Form SC656, also known as the Offer in Compromise Application, should be filed by individuals and businesses who are unable to pay their tax liability in full to the South Carolina Department of Revenue (SCDOR). This form is used to apply for an offer in compromise, which is a program that allows taxpayers to settle their debt for less than the full amount owed.

How to fill out form sc656 offer in?

To fill out Form SC656 (Offer in Compromise), follow these steps:

1. Familiarize yourself with the form: Take the time to read and understand the instructions provided with the form. This will help ensure that you accurately complete all the necessary sections.

2. Provide your personal information: Start by entering your full legal name, social security number (SSN), and current address in the designated fields. If you are jointly submitting the offer with your spouse, include their information as well.

3. Indicate tax years and amounts owed: Identify the tax years for which you are making the offer and provide the total amount owed, including any interest and penalties. Be sure to double-check these figures for accuracy.

4. Calculate your reasonable collection potential (RCP): Use the provided worksheet to calculate your RCP, which is the amount the IRS believes they can collect from you. This involves considering your income, expenses, assets, and liabilities. Complete each section carefully, making sure all values are accurate.

5. Determine your offer amount: Once you have calculated your RCP, you will proceed to determine the amount you are offering to the IRS as a settlement. Keep in mind that this amount should be justifiable and based on your ability to pay.

6. Explain the basis for your offer: Provide a detailed explanation of why you are requesting an offer in compromise, including any special circumstances that may affect your financial situation. Attach additional sheets if needed.

7. Complete the Verification section: Review the verification statement and sign and date the form. If you are jointly submitting the offer with your spouse, they will need to sign and date the form as well.

8. Gather supporting documents: Compile supporting documents such as income statements, bank statements, expense records, and proof of assets and liabilities. These documents will help substantiate the information provided in your offer in compromise.

9. Mail the completed form: Once you have completed and reviewed the form, make a copy for your records and mail the original to the address specified in the instructions. It may be helpful to send it through certified mail or with a return receipt to ensure delivery.

Remember, the offer in compromise process can be complex, and it is advisable to consult a tax professional or seek assistance from the IRS if you have any questions or concerns.

What is the purpose of form sc656 offer in?

The form SC656 "Offer in Compromise" is used for taxpayers who are unable to pay their tax liability in full and are seeking to settle their debt for a lesser amount through the Offer in Compromise (OIC) program. This program allows taxpayers to negotiate with the Internal Revenue Service (IRS) to pay a reduced amount based on their ability to pay. The form SC656 is used to provide the necessary financial information and details to the IRS for evaluation and consideration of the OIC request.

What information must be reported on form sc656 offer in?

Form SC656, also known as the Offer in Settlement, must include the following information:

1. Personal details: The name, address, and contact information of the taxpayer making the offer.

2. Taxpayer identification number: The taxpayer's Social Security Number or Employer Identification Number.

3. Tax periods and liabilities: The tax periods and specific tax types for which the offer is being made (e.g., income tax, employment tax). The form must clearly state the outstanding tax liabilities for each period.

4. Monthly income and expenses: The taxpayer must provide detailed information about their monthly income from all sources and expenses. This includes wages, self-employment income, rental income, and any other sources of income. Expenses should be broken down into various categories, including housing, transportation, utilities, food, and other necessary expenses.

5. Assets: The taxpayer must report all their assets, including cash, bank accounts, real estate, investments, and any other assets of value. If the taxpayer has any assets subject to a lien or encumbrance, those details should also be provided.

6. Offer amount: The taxpayer must specify the amount they are willing to pay as a lump sum or provide a proposed installment plan.

7. Payment terms: If the taxpayer chooses to pay the offer amount in installments, they must provide specific details about the proposed payment terms, including the amount and frequency of payments.

8. Supporting documentation: It is essential to provide supporting documentation to substantiate the information provided. This may include pay stubs, bank statements, tax returns, and any other documents relevant to the taxpayer's financial situation.

It is crucial to complete the form accurately and thoroughly to increase the chances of acceptance by the tax authorities.

What is the penalty for the late filing of form sc656 offer in?

The penalty for the late filing of form SC656, also known as the "Offer in Compromise," depends on the specific circumstances of the case. Generally, if the taxpayer fails to file the form on time as required by the Internal Revenue Service (IRS), they may be subject to penalties and interest.

The penalties for late filing can include:

1. Failure-to-File Penalty: This penalty is typically 5% of the unpaid taxes for each month or part of a month the return is late, up to a maximum of 25% of the unpaid taxes.

2. Failure-to-Pay Penalty: This penalty is generally 0.5% of the unpaid taxes for each month or part of a month the taxes remain unpaid, up to a maximum of 25% of the unpaid taxes.

It is important to note that the IRS has the authority to waive or abate penalties under certain circumstances, particularly if the taxpayer can demonstrate reasonable cause for the late filing. It is advised to consult with a tax professional or the IRS directly for specific information regarding the penalty for late filing of form SC656 in your situation.

How can I edit form sc656 offer compromise fillable from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form sc656 offer in compromise into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit address sc on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign form sc656 in compromise right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out form sc656 on an Android device?

Use the pdfFiller Android app to finish your sc656 offer in compromise form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.