SC DoR SC656 2024-2026 free printable template

Show details

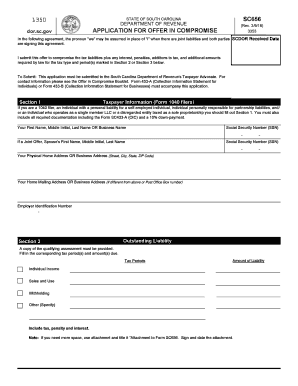

Note If you need more space use attachment and title it Attachment to Form SC656. Sign and date the attachment. Dor. sc.gov STATE OF SOUTH CAROLINA SC656 DEPARTMENT OF REVENUE APPLICATION FOR OFFER IN COMPROMISE Rev. 2/27/24 SCDOR Received Date In the following agreement the pronoun we may be assumed in place of I when there are joint liabilities and both parties are signing this agreement. I submit this offer to compromise the tax liabilities plus any interest penalties additions to tax and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc dor form

Edit your SC DoR SC656 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC656 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR SC656 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC DoR SC656. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC656 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR SC656

How to fill out SC DoR SC656

01

Obtain the SC DoR SC656 form from the relevant authority or download it online.

02

Fill in your personal details in the designated fields, including your name, address, and contact information.

03

Provide the necessary identification details, such as your Social Security Number or other required ID.

04

Clearly state the reason for filling out the form, ensuring it meets the specified criteria.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the form at the bottom where indicated.

07

Submit the completed form through the preferred method (mail, online submission, or in-person).

Who needs SC DoR SC656?

01

Individuals or parties that require official documentation or compliance regarding a specific matter as outlined in the form.

02

Those involved in legal proceedings or administrative processes requiring submission of SC DoR SC656.

Fill

form

: Try Risk Free

People Also Ask about

Can I file my own Offer in Compromise?

You can apply for an OIC directly or with the help of a tax or legal professional. Whether you go at it on your own or submit it with the help of a professional, use the Offer in Compromise Application Checklist in the IRS Form 656 Booklet.

What is a reasonable offer for Offer in Compromise?

There are 2 basic Offer in Compromise formulas: On a 5-month repayment plan: (Available Monthly Income x 12) + Value of Personal Assets. On a 24-month repayment plan: (Available Monthly Income x 24) + Value of Personal Assets.

How much will the IRS usually settle for?

How much will the IRS settle for? The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

What qualifies you for an Offer in Compromise?

You're eligible to apply for an Offer in Compromise if you: Filed all required tax returns and made all required estimated payments. Aren't in an open bankruptcy proceeding. Have a valid extension for a current year return (if applying for the current year)

What is Form 656 Offer in Compromise?

More In Forms and Instructions Use Form 656 when applying for an Offer in Compromise (OIC), which is an agreement between you and the IRS that settles your tax liabilities for less than the full amount that you owe.

What is the average Offer in Compromise?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SC DoR SC656 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your SC DoR SC656 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send SC DoR SC656 for eSignature?

Once your SC DoR SC656 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out SC DoR SC656 on an Android device?

Complete your SC DoR SC656 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is SC DoR SC656?

SC DoR SC656 is a form used for reporting specific data requirements as outlined by the authority regulating the information.

Who is required to file SC DoR SC656?

Entities or individuals who fall under the jurisdiction that mandates the reporting of certain data as defined by the regulatory authority are required to file SC DoR SC656.

How to fill out SC DoR SC656?

To fill out SC DoR SC656, follow the instructions provided in the guidelines associated with the form, ensuring to provide accurate and complete information in each designated section.

What is the purpose of SC DoR SC656?

The purpose of SC DoR SC656 is to collect and track specific information as mandated by regulatory authorities to ensure compliance and reporting standards.

What information must be reported on SC DoR SC656?

SC DoR SC656 requires reporting of data such as entity identification, the nature of activities conducted, relevant dates, and other specified metrics in accordance with regulatory guidelines.

Fill out your SC DoR SC656 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc656 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.